Building Value by Design

We partner with investors to create luxury properties, elevate value, and deliver remarkable return on investment. Take a look at our strong track record of performance and learn more about opportunities to invest with us.

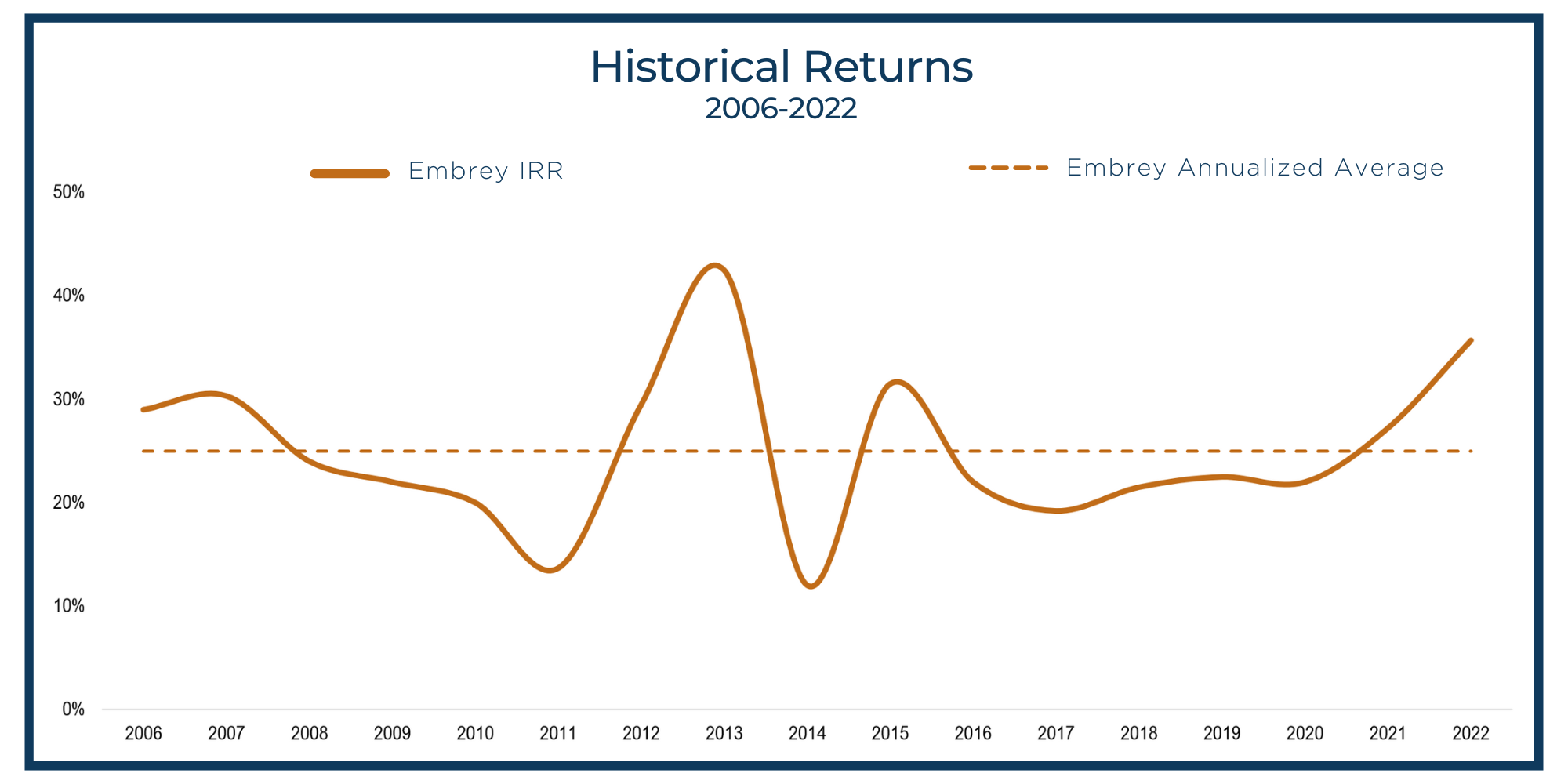

EMBREY’s performance over its 50-year history demonstrates the value of disciplined investing from a well-researched perspective. Our portfolio of opportunities offers both private and institutional capital partners a diverse range of scalable investment options based on asset type, geographic focus, duration, strategic scope, and return requirements. With a keen eye for detail, EMBREY always has the best interests of our investors in mind and the strength of our company’s collaborative approach to inform our vision and actions.

INVEST WITH Embrey

INVESTOR PORTAL

investmentS team

EMBREY Insights Research

Conventional Multifamily Developments

EMBREY develops, builds and manages Class A multifamily properties of various designs, from garden style to urban mid-rise. We create value through smart site selection, meticulous attention to detail, design that elevates the living experience and service-focused management. EMBREY currently develops in over 10 key markets throughout the Sunbelt and Mountain regions and offers opportunities with both shorter- and longer-term investment durations.

Build-to-Rent Communities

EMBREY’s newest product offering is build-to-rent communities, which are low-density developments of duplexes and townhomes built with the same quality and attention to detail as our conventional apartment projects. Units have individual yards and private garages and the communities include amenities such as pools, clubhouses, fitness centers, dog parks and full-service management.

Value-Add and Core Plus Multifamily Acquisitions

EMBREY actively seeks acquisitions that present value creation opportunities through operational improvements, strategic renovations and purposeful asset management. Our acquisitions platform benefits from synergies created with our development, management and construction teams and value is maximized by utilizing a collaborative and tailored approach on every deal. We pursue new opportunities in our core markets throughout the Sunbelt and Mountain regions.

Investment Types

- $100 million and greater funds

- $1 million and greater individual commitments

- Institutional and Private Capital

- Specialized funds focused on a specific asset type or strategy

- $50 million and greater funds

- $1 to $5 million individual commitments

- Private Capital

- Invests alongside Embrey as GP equity

- Financial returns matched to primary equity investor

- $40 million and greater projects

- $5 million and greater individual commitments

- Institutional and Private Capital

- Opportunities to provide LP equity on individual developments and acquisitions

- Both shorter- and longer-term investment duration options

- Land sellers interested in partnering with Embrey on conventional and Build-To-Rent developments

- Financial returns matched to primary equity investor

- Both shorter- and longer-term investment duration options

Current Capital Relationships